State retirement calculator

Further you can use this Retirement Calculator to find out the future value of your current expenses. Retirement Calculator is an online tool which will help you to calculate your retirement corpus.

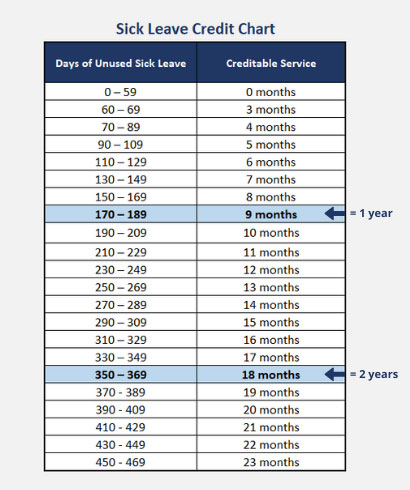

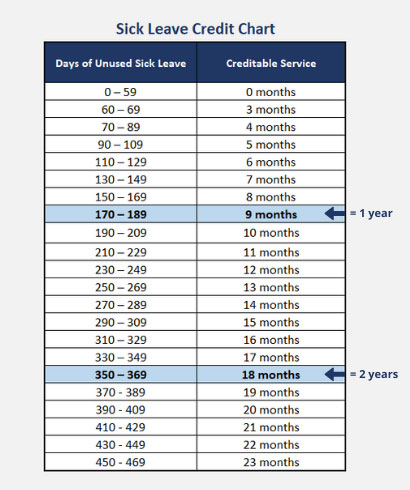

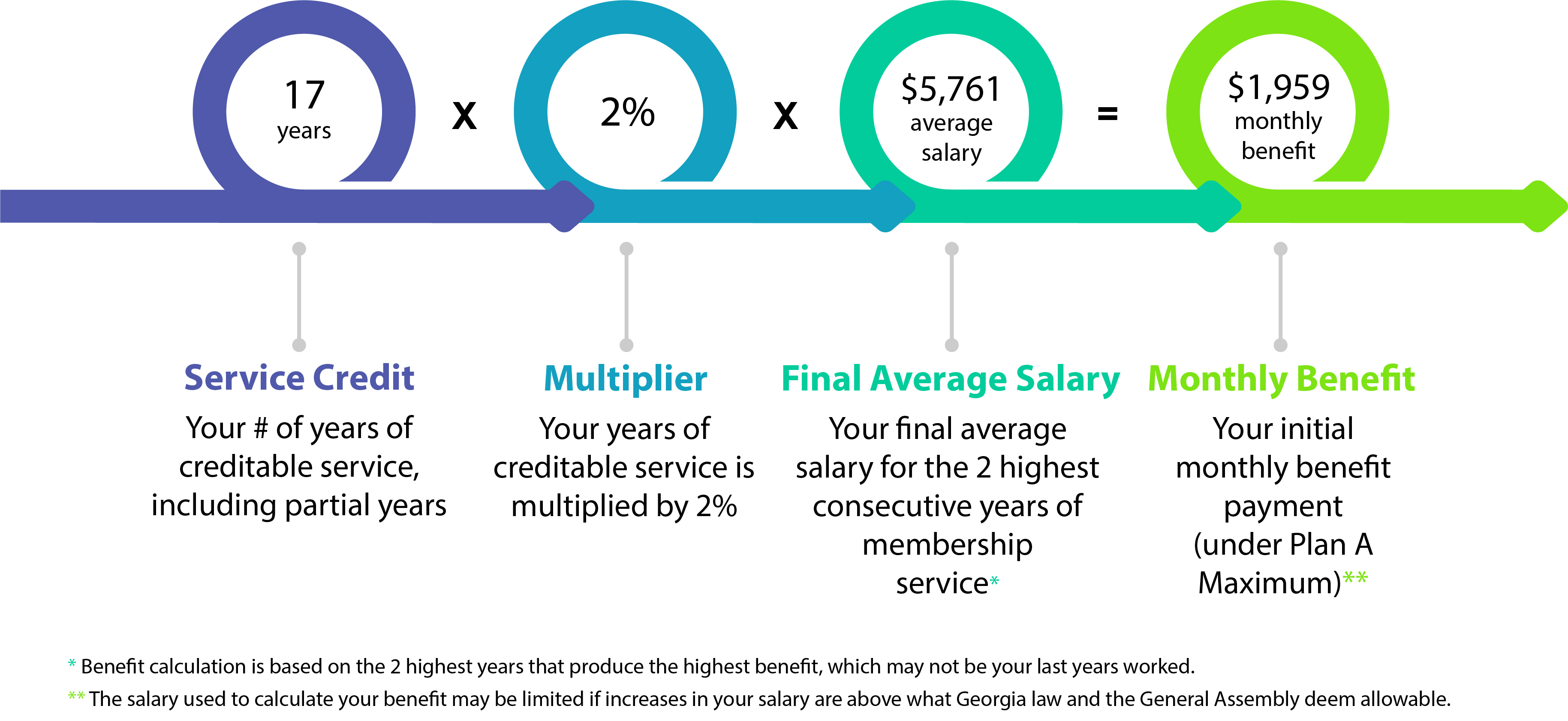

Teachers Retirement System Of Georgia Trsga

Security or the US.

. When clients come to us the state of their investments ranges from the slightly unstructured to the completely messy. The Minnesota Child Support Division bases the Child Support Guidelines Calculator on the Minnesota Child support guidelines statute which became effective Jan. Use our retirement calculator to see how much you might save by the time you retire.

If you dont know where. The AARP Retirement Calculator can provide you with a personalized snapshot of what your financial future might look like. And 2 entered service on or after April 2 2012.

Pension Reform III effective November 16 2011 created a new benefit structure for individuals who became members of Massachusetts public retirement systems on or after April 2 2012. An individual retirement account is one of the most popular ways to save for retirement given its large tax advantages. For example State Pension investment income or other earnings.

Simply answer a few questions about your household status salary and retirement savings such as an IRA or 401k. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. Paychex Retirement Calculator Information.

The calculator provides estimates for members of the State Employees Retirement System 1 who entered service before April 2 2012. Department of Veterans Affairs paid to a joint child due to a parents disability or retirement The monthly cost for both medical and dental coverage. Because benefits are now based in part on an individuals membership date the MTRS distinguishes between two Membership Tiers.

This pension calculator will give members of the Massachusetts Employees State Retirement System in groups 1 2 or 4 an approximation of their retirement benefits. You can put in up to 6000 a year. Where the total income including your withdrawal is above the personal allowance taper threshold the appropriately reduced personal allowance has been used in this calculation.

If your federal state and local taxes are 30 percent a 100 withdrawal will leave you with 70 after. And if youre 50 or older you can.

Estimate Your Benefits Arizona State Retirement System

How Much Do Calpers Retirees Really Make

Teachers Retirement System Of Georgia Trsga

Service Disability Retirement Calpers

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Excel Formula Calculate Retirement Date Exceljet

Retirement Calculators State Farm

Retirement Calculators State Farm

Untitled Document

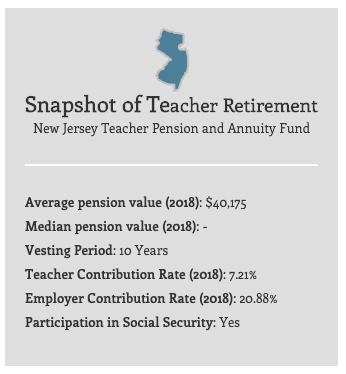

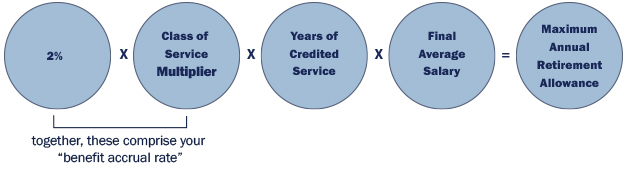

New Jersey Teacherpensions Org

As You Prepare For Retirement You Have A Number Of Decisions To Make Regarding Your Sers Retirement Benefit You Will Document Your Decisions On A Retirement Estimate Request Researching And Considering All Of Your Options Well In Advance Of Your

Estimate Your Benefits Arizona State Retirement System

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How To Calculate Retirement Date From Date Of Birth In Excel

Early Retirement The Western Conference Of Teamsters Pension Trust

2

Fire Calculator When Can I Retire Early Engaging Data